IFCN (International Farm Comparison Network) has just presented a new analysis called “Dairy Processors People, Planet & Profit”. It examines the top 20 dairy processors worldwide in terms of sustainability criteria.

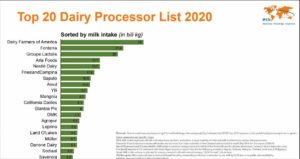

Overall, the top 20 dairies worldwide account for 25% of the total produced milk volume and 42% of the milk processed. The latter figure has not changed over the past few years, illustrating the dynamic growth of these companies in the midst of a globally growing milk production. According to Erik Elgersma, a Dutch consultant formerly involved in strategy development for major dairies, who co-authored the IFCN analysis, the global dairy industry as a whole is by no means a consolidating industry; the latter applies more to the Western world only. Elgersma went on to say that the dairy industry in Asia is in some cases already more developed than that in Europe or North America, in terms of technical standard or business models.

Overall, the top 20 dairies worldwide account for 25% of the total produced milk volume and 42% of the milk processed. The latter figure has not changed over the past few years, illustrating the dynamic growth of these companies in the midst of a globally growing milk production. According to Erik Elgersma, a Dutch consultant formerly involved in strategy development for major dairies, who co-authored the IFCN analysis, the global dairy industry as a whole is by no means a consolidating industry; the latter applies more to the Western world only. Elgersma went on to say that the dairy industry in Asia is in some cases already more developed than that in Europe or North America, in terms of technical standard or business models.

Click to enlarge graphs/tables

“Dairy Processors People, Planet & Profit” is divided into several chapters to provide a better overview of the individual companies and their business. It highlights how the top 20 dairies contribute to people, the planet and sustainable profitability. In total, the Top 20 represent 210.5 billion kg of milk processing, supplying over a billion people with milk products and paying $71 billion in milk bills per year. They directly employ 460,000 people who represent $21 billion in payroll, while they provide several times more farm employment (IFCN estimate: 2 to 5 million people) and they pay $3 billion in corporate taxes. 50% of the companies have already declared that they will be climate-neutral in 2050, the rest are currently working on strategies to achieve this.

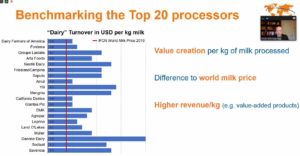

In the dairy industry, with an average EBITDA of 8%, the focus is not so much on making profit as on supplying consumers. Other sectors, such as the general food industry (12.5%) or the food service (10%) are much more profitable.

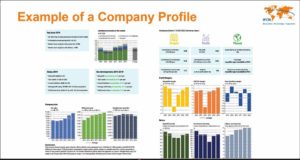

In a web conference for almost 490 participants from around the world, IFCN today presented details of the new report. Each company is portrayed on two pages, with the data being evaluated to make it meaningful. Ten Key Performance Indicators (labour productivity, wage development, capital employed per kg of milk, free cash flow margin, tax rates paid, etc.) allow a more accurate assessment of the company’s performance, but also allow benchmarking of one’s own company against the big players in the industry. With a value creation of 0.8 $/kg milk, cooperatives perform worse than private companies and multinationals (1.1 $/kg) in the group under consideration. This is not directly comparable, however, according to Elgersma, as the business models are quite different and the product mix also varies. As IFCN did not receive all data directly from the companies, they had to estimate some of the data. The authors of the study are certain, however, that these are not too far away from reality.

All graphs/tables: IFCN